are foreign gifts taxable in the us

The gift tax does not apply to any transfer by gift of intangible property by a nonresident not a citizen of the United States whether or not he was engaged in business in the United States unless the donor is an expatriate and certain other rules apply. If you are a US.

Foreign Income Taxes Explained Picnic S Blog

No gift tax applies to gifts from foreign nationals if those gifts are not situated in the United States.

. Citizen and lives and works in Beijing China. You will not have to pay tax on this though. If the donor is.

Gift tax rules only if the asset transferred is situated in the United States referred to as US. Citizens there is an annual exclusion of 10000 per donor for each donee gift. The IRS defines a foreign gift as money or other property received by a US.

Receiving gifts from foreign citizens. Which Gifts Are Taxable. In other words if a US.

Taxes the gift giver the donor. If a person is a non-resident alien for purposes of gift tax taxation of gifts is determined in a different way. As with the gift tax rules for US.

Person recipient may lead to extensive fines and penalties. A non-resident alien donor is subject to foreign gift tax on transfers of real and tangible property situated in the United States. Is not unique in taxing donors on their gifts.

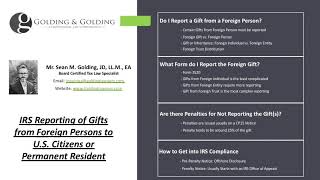

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Domiciliaries are subject to transfer taxes on their worldwide assets. Person who receives a gift from a foreign person must pay tax on the gift.

1 And some countries without a gift tax per se have a deemed disposition tax or an income tax on gifts which is essentially a tax on accrued capital gains in the assets being gifted. Person must report the gift when the threshold is met on IRS form 3520. If you receive a non-cash gift from a foreign person it may be taxable if it is US.

Gift splitting is not available to foreign nationals not domiciled in the United States. The majority of financial gifts sent abroad will be tax-free unless they exceed the following limitations. Conversely when it is a foreign person with US property that 11 million exclusion is reduced all the way down to 60000.

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed. Domiciliaries also enjoy a large unified gift and estate tax exemption on the transfer of their.

Therefore when acquiring US real estate. Foreign gifts are subject to US. Citizen and lives and works in Beijing China.

There are differences in the foreign gift tax treatment of cash and property. As with the gift tax rules for US. In legal terms the gift isnt US.

If the property is not located in the US there is no gift tax. Citizen spouses are free of gift tax. Foreign gifts are subject to US.

Generally the answer is No. When a US person passes away their estate is entitled to an 11000000 exceptionexclusion so that most of the time there will be no estate tax due by the decedents estate. Even though there are no US.

While some countries tax the receiver of the gift the donee the US. Gifts to foreign persons are subject to the same rules governing any gift that a US. Tax ramifications on the initial receipt of a gift from a foreign person although usually an IRS Form 3520 is required the lack of reporting of the foreign gift on behalf of the US.

Gift tax will apply differently in accordance with whether the donor is a US. There are no specific IRS taxes on gifts received from a foreign person. As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed.

Typically if a foreigner gifts money or property except intangibles such as securities to anyone in the world and the transfer originates or is completed or the gifted property is located in the US the foreign transferor must pay a gift tax if the value of the gift exceeds 15000 per beneficiary in calendar year 2019. 2 Others may have pull-back provisions in the event the donor passes. 1 And some countries without a gift tax per se have a deemed disposition tax or an income tax on gifts which is essentially a tax on.

Person from a foreign person foreign estate foreign corporation or foreign partnership that the recipient treats as a gift and can exclude from gross income. Person receives a gift from a foreign person that specific transaction is not taxable. If you are given money from a United States citizen as a gift you do not have to declare it or pay tax on it.

Resident for income tax purposes but not for gift tax purposes. Form 3520 is an information return not a tax return because foreign gifts are not subject to income tax. It is possible for a foreign citizen to be considered a US.

Is a taxable gift. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Otherwise you must file IRS Form 3520 the Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Chris is not a US. Citizens spouse can be given free of tax. You give gifts of future interests ie.

Gifts of up to 100000 per year to a non-US. 7342 FGDA an employee may not accept a gift exceeding 415 effective January 1 2020 in value from a foreign government or an international organization. There is no specific IRS taxes on gifts received from a.

Many other countries tax their residents on gifts with rates as high as 50.

Receiving A Foreign Gift You May Need To Tell The Irs The Wolf Group

Form 3520 Us Taxes On Gifts And Inheritances

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Gifts From Foreign Corporations Included As Gross Income

Completed Sample Irs Form 709 Gift Tax Return For 529 Superfunding Front Loading

Gifts From Foreign Persons New Irs Requirements 2022

6 Things Expats Need To Know About Taxes Before Moving Abroad

International Tax Foreign Accounts Foreign Income

How To Report Foreign Earned Income On Your Us Tax Return

Foreign Gifts When Do You Have To Report Them Freeman Law

Taxes Reporting A Foreign Gift Or Bequest Strategic Finance

Foreign Gift Taxes What You Need To Report Greenback Expat Tax Services

Foreign Gift Reporting Penalties Thresholds For Purposes Of Reporting A Foreign Gift Form 3520

Irs Reporting Requirements For Gifts From A Foreign Person

San Francisco New Federal Inheritance Tax Sf Tax Counsel

Foreign Gift Reporting Penalties Thresholds For Purposes Of Reporting A Foreign Gift Form 3520

Gifts From Foreign Persons New Irs Requirements 2022

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law